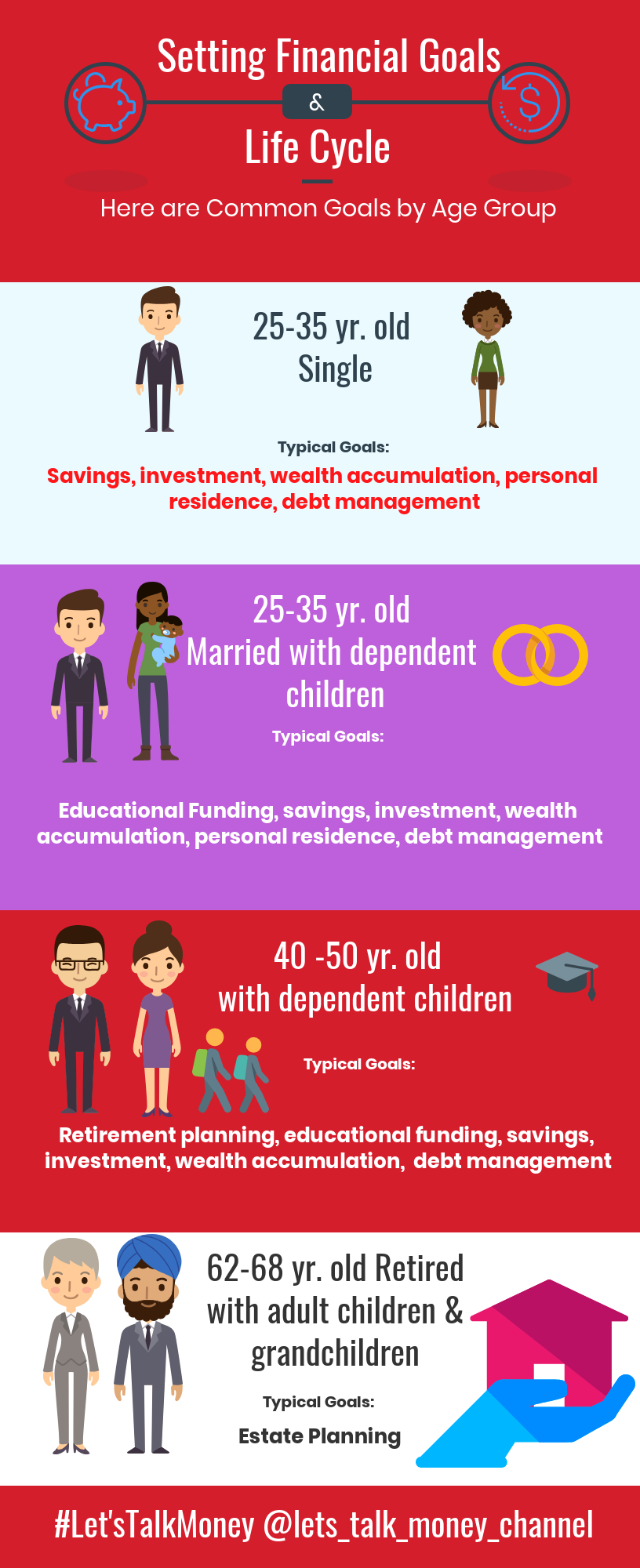

Here are three financial planning templates, useful for people with various ages. Each of these templates explains the most important points, one should remember while starting to his personal financial plan at any age group, given here. You can use this as your basic template to plan your finance well.

This article not intends to discuss all about the financial planning. But, it discusses the most required consideration when planning your finance at various ages. By providing some very useful and most important hints, it helps you to plan your finance considering your age. If you want to know more step by step details to start financial planning, this is the right article series for you.

Financial Planning Template 1 – Age group of 20 – 35

Between the age group of 20 to 35 considers as the accumulation phase. This is your golden time to save maximum money and invest on any instruments that suitable to your various long, medium and short term goals. If you are going through this life stage, you can have an equity exposure of 80% with your portfolio to create wealth for long term. Also, a person in this age group should start budgeting to know his cash flow as the preliminary step of personal financial plan.

Through budgeting, one should control any unnecessary expenses and utilize the money to constructive uses. He should consider protecting himself with enough term cover policy to secure the future life of his dependents. It is better to apply at the early but especially if you are near to the age of 30, you must consider to have a term policy with minimum premium and the cover equal to 6 times of your annual salary, a family floater medi-claim policy as well as most required asset protection policies required at this time. Here is an article dealing with most required insurance plans for your reference.

If you have debts, you should consider paying off the same before starting your financial plan. To allocate your funds, a portfolio proportion of 80% in equity and 20% in the debt instruments will be excellent for those who are in this age group.

You can consider the below investment instruments to build an equity portfolio:

1. Direct stock investments – Aggressive style with mix of large cap, mid cap, small caps in right proportion 2. Diversified / Sector / Thematic mutual funds

3. Index funds and Exchange Traded Funds (ETF)

4. Unit Linked Insurance plan – Investments 5. Real estate investment 6. You can even add high risk commodity options and futures to your portfolio at this time by considering your risk profile.

For 20% debts side, one can consider fixed deposits that giving compounding interest and secured government bonds. Well performing debt funds and money market funds also can be added to the portfolio.

This is the right time for you to start investments for your kid’s future. You can start and account for your kid at this time. Consider to have one with compounding interest and add little amount in each month to it for your kid. If you have any long term plan like buy a home, kid’s education or marriage etc, this is the right time to plan your investment portfolio to achieve these goals.

Financial Planning Template 2 – Age group of 36 – 45

If you are in the age group of 36 to 45, you now have family, children and other dependents. As a person who is the bread winner, you should consider to protect your life with maximum coverage. Selecting a cheap term policy with enough coverage will be a better option at this time. Your family should be under the coverage of a good medi-claim policy and you should cover your vehicles with third party liability policy and your assets from any kind of lose. This is the time you highly require an emergency fund with sufficient money. As a general practice to deal with such, hold an amount equal to your 6 months salary to a separate savings account to protect from any emergency cash requirements.

Consider to teach your kids about money and saving methods of the same. This will later lead them to the habit of being conscious when spending money. A person who is in this age group should consider a balanced portfolio than previously said aggressive one. A portfolio proportion of 60% in equities and rest in pure debt instruments will work better for you.

Below are the possible investment instruments one can prefer to meet the 60% equity portfolio.

1. Direct stock investments – Balanced style. Large cap companies from defensive sector like Pharma and FMCG will be better. 2. Balanced Mutual funds 3. Index funds

4. Gold ETF

5. Unit Linked Insurance Plan – Pension Plan

You can select the following to your debt portion :

1. Fixed Deposits with Banks – One which provide compounding interest will be fantastic 2. Savings Bonds 3. Maximize contribution to employer pension plan or 401k 4. Well secured bonds from government or public companies You should be well aware that this is the time to plan for your pension. Above investments should focus as per this requirement along with the need of your kids future.

Financial Planning Template 3 – Age group of 46 – 55

If you are in this age, you are near to your pension. A considerable portfolio at this time will be 20% to the equity as maximum and rest 80% should be in the secured debt funds. Medical insurance is the must required one at this time.

You can have the following to your 20% equity portfolio

1. Stocks – Highly defensive heavy weight blue chips 2. Balanced mutual funds

3. Exchange Traded Funds

As we are giving preference to the debt instruments to your portfolio, consider to park your money to the following instruments.

1. Secured bank fixed deposits with compounding interest 2. Capital secured liquid funds 3. Fixed Maturity Plan (FMP) mutual funds. Never, ever invest with ULIP insurance plans or equity at this time. Especially, you should deal with your pension fund and never touch the same for investing plan. A person near to the pension age or after pension always prefer to park his money to well protected deposits and easily available at any time. Always prefer to invest on any instrument that you have good knowledge with. I never encourage a person to directly invest to the stocks because of the knowledge and time required to identify good companies.

While planning your finance, it is better to have a well qualified and experienced financial planner than any investment trusts or companies that offering investments behalf of you. If you getting a good financial planner, that is enough for you and he can bring you up by providing all the necessary knowledge and updates time to time. Here is an article for you to read and select a good financial planner by considering the most required qualities.

Once after you start your retirement life, you should be careful to add all your money to well secured deposits, government backed monthly income plans from banks or post offices. This is due to no time you have in front of you to earn money now. This is your golden time and enjoy with all the benefit from the well structured financial plan you have made at your good times. Remember, this article nor limited to any boundary or type of money. This is in general and applicable to anybody from anywhere in this world. The only drawback is, I am not aware about the type of deposits in each countries providing and how the interest of the same calculating. You have to prefer a better one by considering the low cost or no cost but facility of compound interest than flat interest to your fixed deposits.

Best wishes to all the readers to have a most successful and fail proof financial plan. God bless each of you for the same.

WHAT IS NEXT?

- Post a comment

- Share your experience or examples

- ‘Share this’ article

- Participate my Poll

- Write a guest article to investinternals@gmail.com