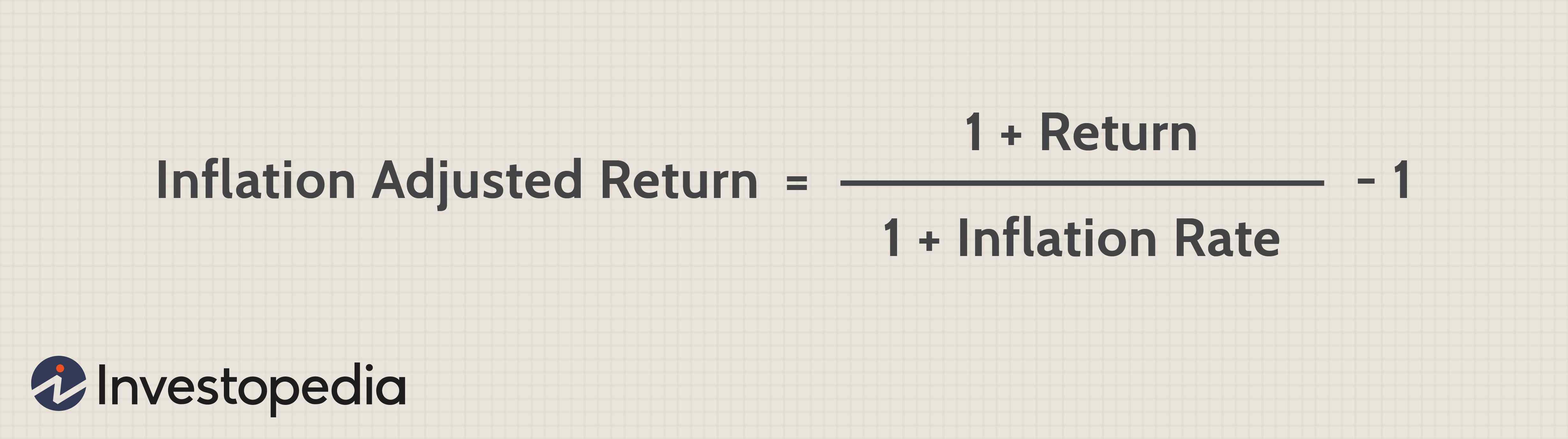

One of the difficult calculation for investors and common people, if they are not good with numerical skills, are the calculation of Inflation adjusted future expense and the future value of their investments. To make this calculation understandable to everyone, here is a simple formula that tells you the required once provide the necessary data to it.

This formula is to calculate the future value of any investments. An enhanced advantage of this formula is, it will allow the person to understand the inflation adjusted final value. This formula thus helpful to calculate the inflation adjusted future expense of your family compare with present expense and helpful to plan and invest accordingly to the future requirements. Knowing this formula is a must for all while doing the financial planning because of its capacity to itself predict and calculate inflation adjusted future returns on your portfolio.

Financial planners frequently uses this formula to calculate the inflation adjusted future expense amount requirements of there clients comparing with present expenses. They are also using this formula to identify the possible inflation adjusted returns on investments to plan the above expenses in the future. Comparing both results, they can easily identify possible investment instruments to their clients to prefer for investing.Suppose your monthly expense is 5000 (any currency or in any country) and the inflation rate is 7%, you required to know what will be the monthly expense after 15 years instead of present 5000? It can be done by using below formula. MS Excel is the best for this kind of calculations:

=Present expense amount * (1+inflation%)^number of years

Example to the above given scenario with 7% inflation and after 15 years (this can be changed as per your convenience. However try to add maximum inflation to get the amount that later cannot come as insufficient due to the errors in the calculation of inflation rate. I prefer adding an inflation rate between 10 to 14:

=5000*(1+7%)^15 = 13795 /-

5000 = Your present monthly expense

7% = Expected inflation inflation rate

15 = Number of years

13795 = is the amount you required per month after 15 years instead of present 5,000, with an inflation rate of 7%. If the inflation rate is more, the amount also increased accordingly.The same formula you can use to identify the maturity value of your investment after a period of time. In this case, the 7% will be considered as the interest rate of your investments.

Refer the article how the compounding interest formula works. It is a highly useful one to identify the real rate of returns after a period of time if compound basis interest calculation uses.

If you have any idea to enhance this article in a more effective way, do it in your own blog or comment here to share with readers of this blog.

This is an enhanced version of a previously posted article in this blog on similar subject.

Sherin Dev is the founder and editor if Investinternals.com Blog. Learn more about him here. Follow him on Twitter @Moneyhacker or be in touch at Facebook

If you have any queries like to add a guest article in this blog, contact him at investinternals@gmail.com