Article written by Sherin Dev; Follow me in Twitter or Facebook . To get latest news and articles Subscribe for free!

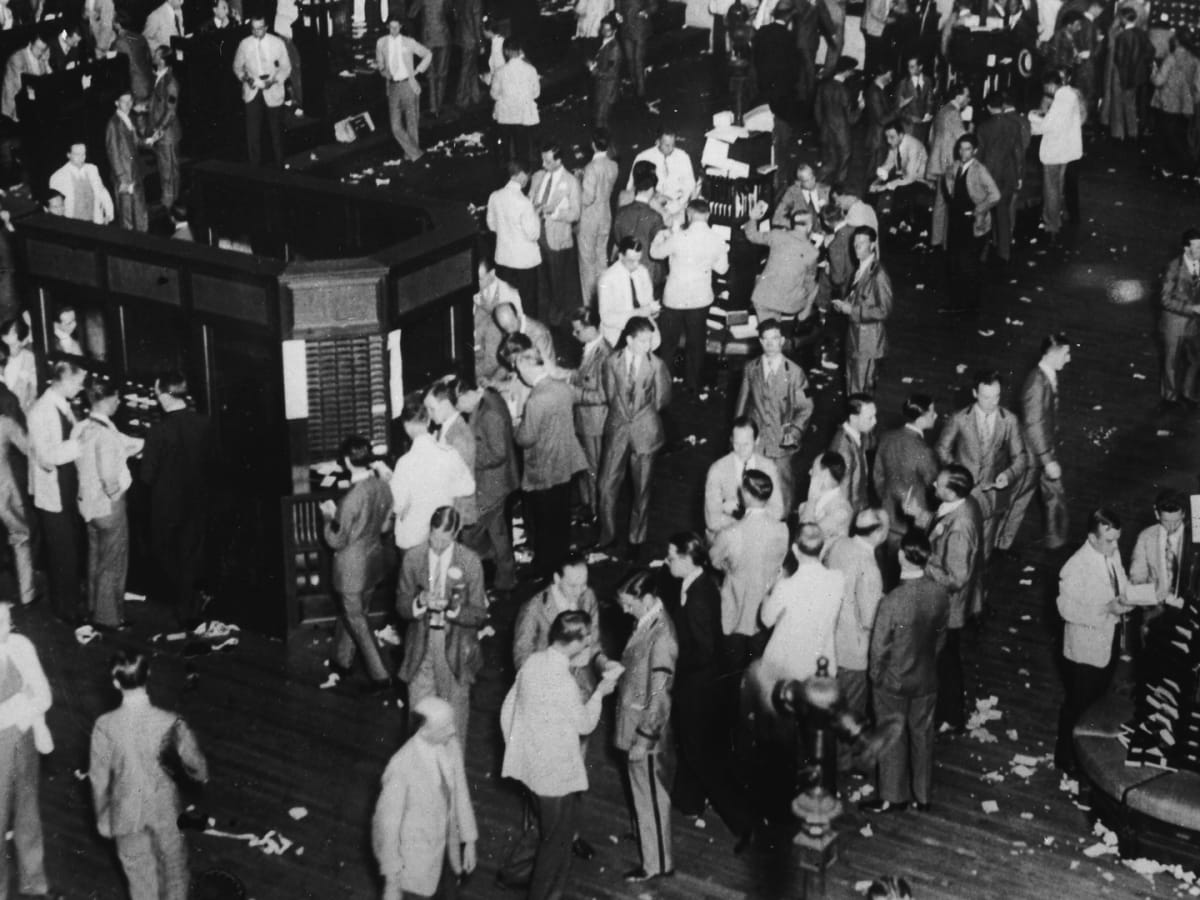

All of we are aware about the fluctuations in the stock markets. Stock markets should have fluctuations to throw up buying and selling opportunities to investors. A continuous growing index never give you better buy or sell opportunities. But, what are the possible reasons behind huge market falls? This article revealing such major factors, that can affect a market at any time and can give huge lose to investors if not acting properly. Keep reading..

1. Inflation : The most dreadful and dangerous reason behind any stock market fall. Raising prices for all the available resources will increase the production costs and thus will affect companies profit and stock holder earnings. This situation can bring a market down immediately. If such situation arises, investors will be panic and immediately try to sell the stock holdings they have, to book maximum profit. Growing interest rate also a fearful truth when inflation reaching high.

2. Instable political conditions – Instability of government in any country can affect stock markets immediately. Expectations on a general election and right or wrong predictions on the negative possible actions by future government can be oil to the panic fire. This will lead investors to make sell decisions to book profit at the earliest. Immense selling activities lead the stock market to down trend.

3. Fuel price hike – International fuel price hike can affect companies badly with large production costs and that will negatively reflect to profit and earnings. This can be an another good reason for huge down trend.

4. US economy slowdown – As the only superpower in the world, economic growth in US have major influence to the growth of other countries. Present down fall of all prominent stock markets worldwide is a clear example of this influence by the slow US growth of US economy.

5. War clouds and rumors- Continuous newses on a war or possible attack on any country can affect the stock markets worldwide. If the country under such treat and is a major producer of anything that world eagerly required, will certainly affect world economies as well as stock markets growth. Best example is Iran. They are major producers of Oil and most of the economies in the world are there customers. Recent newses on America’s war preparation against Iran raised the fuel price very rapidly. This action caused huge increase in companies production costs and thus the financial results are not good as expected. Low earnings and reducing profit are the major reason behind the huge market down fall of most third world countries.

6. Large selling activity by FII’s and institutional bodies – Foreign Institutional Investors activity have major influence in any stock market. Most of the retail investors doesn’t have enough knowledge but they are always eager to watch the activities going on the stock market. FII’s activities will be always under there lens. Large FII selling activity immediately raise panic alarm to these retail investors and they also start to sell there holdings. This continuous selling activity can bring stock markets down.

7. Rumors: rumors in between the retails investors can put the stock market in pressure and possible down trend. Investor should be conscious about the fact inside the rumor. If you are aware investor, you can be alert immediately to utilize the possible forthcoming buying opportunities.

Above are some major reasons that can badly affect a stock market and can pull the index down. In a growing economy like India or China, most of the bear timings are temporary and offering excellent opportunity to retail investors as well as organizational bodies to buy there favorite stocks cheaply.

As a long term investor, invested with carefully selected good growth companies, we are no need to panic on any down falls by any of the above reasons or factors. This is a truth revealed by legend value investors by there actions and is always a clear winner on short term traders.

There are numerous other factors can bring a market to down path. But most of them seems to be temporary. Above mentioned factors can start a bear run for long term or considerable time. Carefully investing is the only way to overcome such situations. As I mentioned in my previous article, patience is the must have quality for a customer to overcome such situations that put you in panic and lead you to take wrong decisions.