We live in the digital age where everything happens at the speed of light. We rush around through the day doing our jobs, meeting deadlines. And in this hectic pace of life , we forget to take care of something important- our health. We are so busy tackling the challenge of balancing work and personal lives that we forget to take care of ourselves. Amidst all this rush, we do not even realize when the daily travel, changing weather conditions, pollution, stress, etc, alters our lifestyle and takes a toll on our health. The result- we become more vulnerable to critical diseases, that too, at an early age.

How many times have you been surprised at someone below the age of 35 suffering from heart-attack or undergoing bypass surgery? On thinking you will realize, that the instances have been quite frequent in the past few months. This validates the findings of the World health Organization (WHO), which mention India as one of the nations that is going to have most of the lifestyle related health disorders in the near future.

In such a scenario health insurance especially a critical illness plan becomes critical. As you are aware, the cost of treatment of these diseases is extremely high, and has the potential to cripple the household finances if not planned for. If the breadwinner of the family is diagnosed with any critical illness, it endangers not only individual’s health but also financial well being of a family.

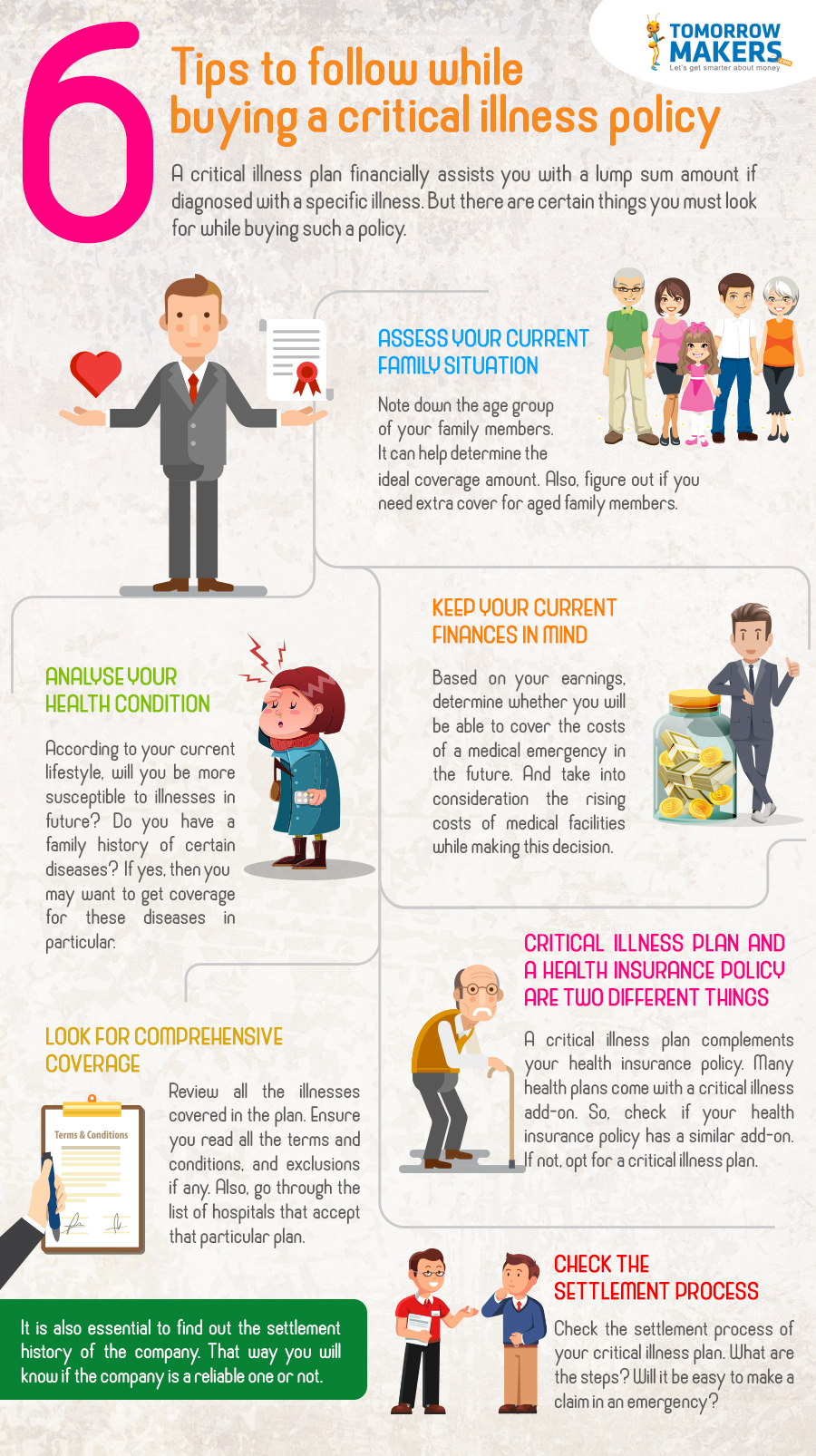

Hence, a critical illness plan becomes a must in any portfolio. The main purpose of a ‘critical illness plan’ is to protect the person against any financial liabilities, which arise out of serious illness covered under the policy. The plan, offered by Life Insurance companies, provides the policyholder with a lump sum amount on diagnoses of any critical illness covered by the policy thereby ensuring that the family has adequate funds to meet the unplanned medical expenses and get the best possible treatment.

However, do not confuse your medi-claim policy with a critical illness plan as the former alone may not be sufficient to protect your family’s financial needs.

With a critical illness plan, one gets a fixed amount irrespective of the costs that they have incurred. This amount is pre-decided at the time of buying the policy. In a medi-claim policy, one is either reimbursed the amount based on the actual hospital bills or through a cashless facility.

I would recommend both types of policies for a complete health insurance portfolio especially for the earning member of a family. While the medi-claim plan covers a certain portion of the hospitalization expenses, the critical illness plan offered by Life Insurance companies helps tide over any additional expenses that may not be covered by the other policy. Also in some cases, the earning member may not be able to resume work temporarily and the lump-sum received from the fixed benefit plan will help supplement the household income.

Many insurance companies also offer a rider which can also be attached to the main life insurance policy for critical illness. The rider is called “waiver of premium rider for critical illness”. You can attach this rider to your insurance policy which would result in no further premium payments if you are diagnosed with any of the critical illness, although it’s not exactly similar to the critical illness plan.

This article has been written by Aviva India.