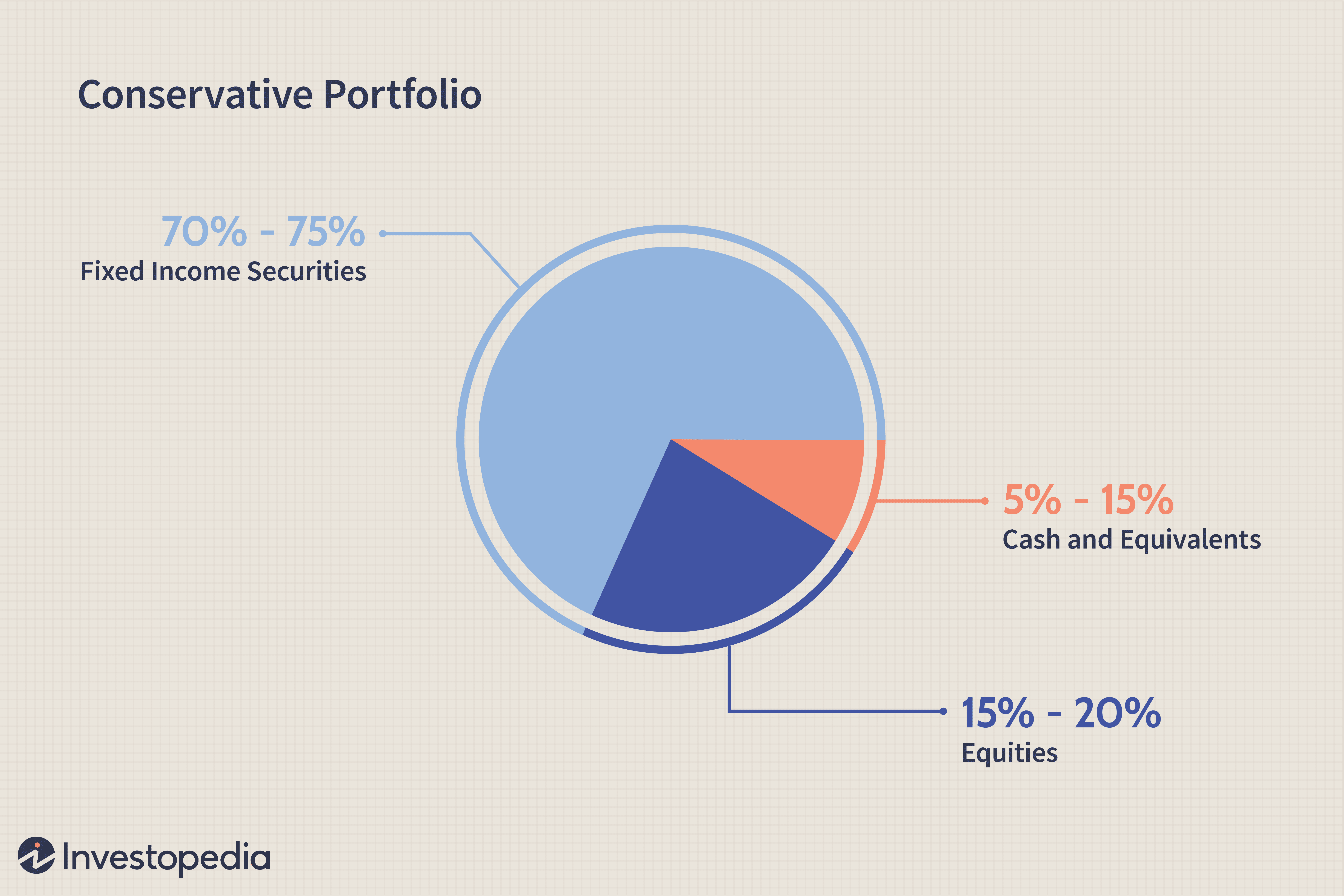

If you want to be a right value investor, one of the most important requirement should be creating a set of well studied, fail proof investing policies. Creating policies depends on the nature and mind set of an investor and that can vary person to person. Any knowledge that able to support you when creating your personal investing policies would be best to refer and adopt. In this article, I have focused some of the factors that able to help you when creating your personal investing policies.At the first, plan your asset allocation. With asset allocation, you are deciding your investment proportion to different investment instruments. A simple example is, 60% in stocks and 40% in bonds. A golden theory to remember here is, deduct your age from 100 and that percentage keep in equities. Suppose, you age is 36 and 100-36 = 64. Here, 64% of your allocation will go to equities and rest 36% to bonds. Within the broad categories of equities and bonds, you can create subsets – a certain percentage allocation to large and small US stocks, international stocks, emerging markets, treasuries, high yield bonds and so on.The second part – the one, most individuals and investors ignore is, requirement of re-balancing portfolio time to time. through re-balancing, an investor reducing the risk of investment lose compare to his age and risk. For an example, if you have choose 64% of stocks in your portfolio (refer previous paragraph). After an year, the worth of your stock reached to 68% by up of 4%. To re-balance your portfolio, you can sell the surplus 4% and allocate that money to something else or expanding your investment portfolio. In the similar way, If the value of debt funds goes up, you can sell the surplus and invest it in stocks.This method not only balancing your portfolio but, help you to expand your portfolio to next level and helping to bag your profits time to time.Of course, this is not enough to create an investing policy. But, as I said earlier, these are two tips to support your policy creation process by giving better knowledge on asset allocation and re-balancing.If you have any queries, you can comment here and I will look into that to give reply to you.