Income Tax Department has come up with many changes with regard to filing Income Tax Return for the Assessment year 2013-14 relating to the financial year 2012-13, one of most important of those is applicability of ITR forms for various assessees.

Income Tax Department has come up with many changes with regard to filing Income Tax Return for the Assessment year 2013-14 relating to the financial year 2012-13, one of most important of those is applicability of ITR forms for various assessees.

Let’s understand applicability of these forms for different assessees.

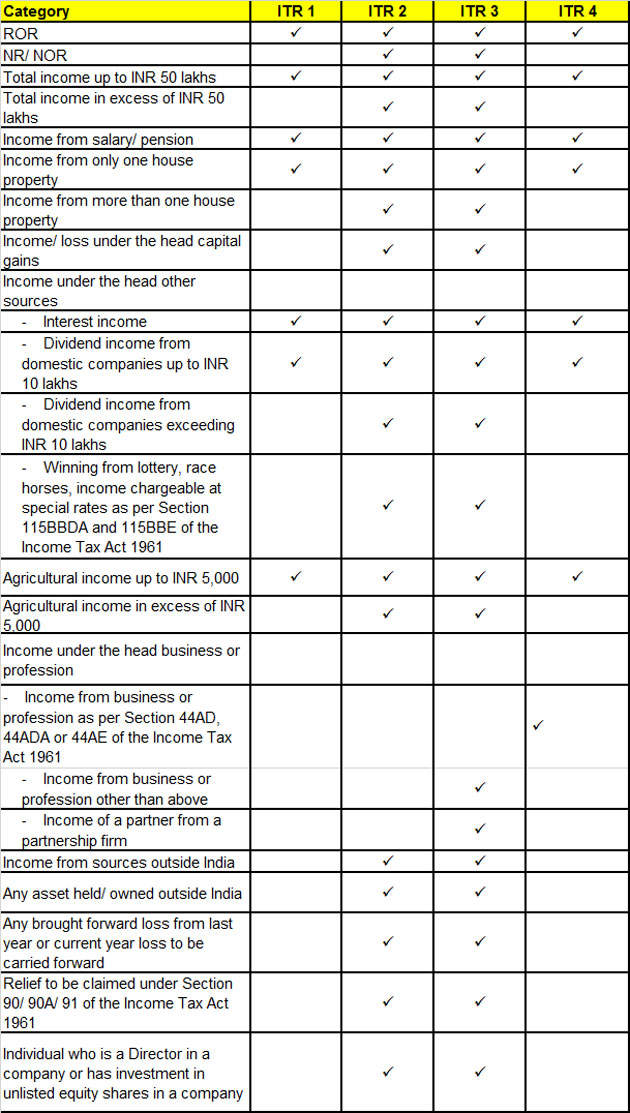

Who can use ITR-1 Form? – SAHAJ or the newly ITR–1, has replaced SARAL Income tax return. The main motive behind this is to simplify the existing return forms to reduce return filing burden on the Individuals. ITR–1 Form is to be used by an Individual having income from following sources: – Income from Salary/ Pension – Income from One House Property (not being brought forward losses from previous years) – Income from Other Sources (not being income from lottery or race horses) Moreover, in case any income of spouse, minor child, etc. gets clubbed with the income of the assessee, then ITR–1 can be used only if the clubbed income falls into the above income source.

Who cannot use the ITR–1 Form? – ITR–1 Form should not be used by an Individual if his total income consists of:

– Income from more than one house property – Income from Winnings from lottery or income from Race horses – Income ( not exempt from tax) under Capital Gains – Income exceeding Rs. 5,000 from agricultural business – Income from Business or Profession – Income from stock & equity mutual funds – Losses which has to be carried forward – Person claiming relief of foreign tax paid under section 90, 90A or 91 An individual who is a resident having assets (including financial interest in any entity) located outside India or signing authority in any account located outside India.

Who can use ITR-2 Form? – The Income Tax Department has provided various Income Tax Forms for the assessees in order to file their return forms beneficially. The filing of return Forms depends upon the income earned by an assessee. ITR 2 is used by an individual or a Hindu Undivided Family whose total income comprises following income:

– Income from Salary / Pension – Income from House Property – Income from Capital Gains – Income from Other Sources (including income from Winning from Lottery and Race Horses) Moreover, if the income of spouse, minor child, etc. is to be clubbed with the income of the assessee, then ITR 2 can be used if such income falls in any of the above categories.

Who cannot use the ITR-2 Form? — ITR 2 is not used by

An Individual/ HUFs if his total income includes any income taxable under the head “Profit or Gain from Business or Profession. In other words, business or professional income does not form the part of ITR-2.

The person already using ITR-1 Form.

A Partnership Firm having exempt income by way of shares (& not earning any income by way of interest, salary, etc.).

Who can use the ITR-3 Form? – Income Tax returns filing has to be done in Income Tax Forms which is provided by the IT Department and applicable to assessee according to the income earned. Now-a-days the process of filing is too easy and hassle free for the assessees. A person being an Individual or HUFs who is a partner in a firm is required to use ITR-3 form whose income chargeable to income-tax under the head “Profits or gains of business or profession” should not include any income except the income stated below:

– Interest – Salary – Bonus – Commission or – Remuneration By whatever name called, due to, or received by Individual or HUF from such firm.

Who can use ITR-4 Form? – Income tax return is filed through ITR form which is based on the income earned by an assessee. Most individuals are confused about which ITR form they should use for filing their income tax return. Here is a brief discussion on ITR-4 and ITR-4S & its applicability.

Who can use the ITR-4? – ITR-4 Form is used by an Individual or HUF who is carrying out a proprietary business or profession and who are not filing Return under Presumptive Taxation Scheme. The following income can be included in ITR-4 form: – Income from Salary/Pension – Income or Losses from House property – Income from Business Profession – Income or Losses from Capital gains – Income or Losses from Other Sources Moreover, every Partnership firms, Individuals & HUF having their tax audits mandatory u/s 44AB is required to file their ITR-4 Electronically using digital signature.

Who cannot use the ITR-4? An Individual or a HUF computing business income from Presumptive Taxation Scheme are not eligible to file ITR-4. For Presumptive Business Income, an assessee files ITR-4S (SUGAM).

Who can use ITR-4S? – For Presumptive Business Income an assessee needs to file his return using ITR-4S Form (commonly known as SUGAM).

Who can use the ITR-4S? – ITR-4S Form is applicable on Individuals, HUFs & small business taxpayers deriving income from Business income where Presumptive scheme under section 44AD & 44AE of the Act is used for computation of business Income:

– Salary/Pension – One House Property – Other Sources Moreover, in case any income of spouse, minor child, etc. gets clubbed with the income of the assessee, then ITR-4S can be used only if the clubbed income falls into the above income source. Also, the above income will be deemed to be computed after considering every losses, allowances, depreciation, etc.

Who cannot use the ITR-4S? – ITR-4S is not applicable if income is derived from:

– More than one House Property – Winning from lotteries/horse races – Capital gains not exempt from tax – Agricultural Business in excess of Rs. 5000 – Speculative Business – Losses to be carried forward

Return in ITR-4S cannot be filed by a person, who:

a) Is a resident Individual or a HUF (other than not ordinarily resident in India) deriving income as referred to in section 44AD or 44AE, and has: Any asset (including financial interest) located outside India; Signing authority in any account located outside India; b) Has claimed any relief of tax under section 90, 90A or 91; c) Has income exceeding Rs. 5,000 which is not chargeable to tax. In other words, if assessee claims exemption in respect of any income under sections 10, 10A, 10AA, etc.

Who can use ITR 5?

The form can be used by a person being a: – Firm – AOPs (Association of persons), – BOIs (Body of individuals) – Any other person

Who cannot use ITR 5?

The form should not be used by a person being an: – Individual – HUFs – Company – And to those persons to whom ITR-7 is being applicable.

Who can use ITR-6 Form – ITR-6 can be used by a company, other than a company claiming exemption under section 11.

Who can use ITR-7 Form – ITR 7 Form can be used by persons including companies who are required to furnish return under:

– Section 139(4A) : Filing return by charitable/Religious trust – Section 139(4B) : Filing return by political party – Section 139(4C) : Filing return by certain Institutions – Section 139(4D) : Filing return by Scientific Research University No documents are required to be affixed with any ITR Forms. ITR Forms can be filed either manually or electronically, with or without digital signature, with the Income Tax Department.

About Author:

Alok Patnia founded Taxmantra.com to understand and address the pain points of individuals, businesses and startups. He is an expert in handling ITR filing, has great insights on the business startup issues such as choosing right business entity and also has vast experience in the field of business maintenance services such as accounting, auditing, company law compliances, service tax and other related fields.