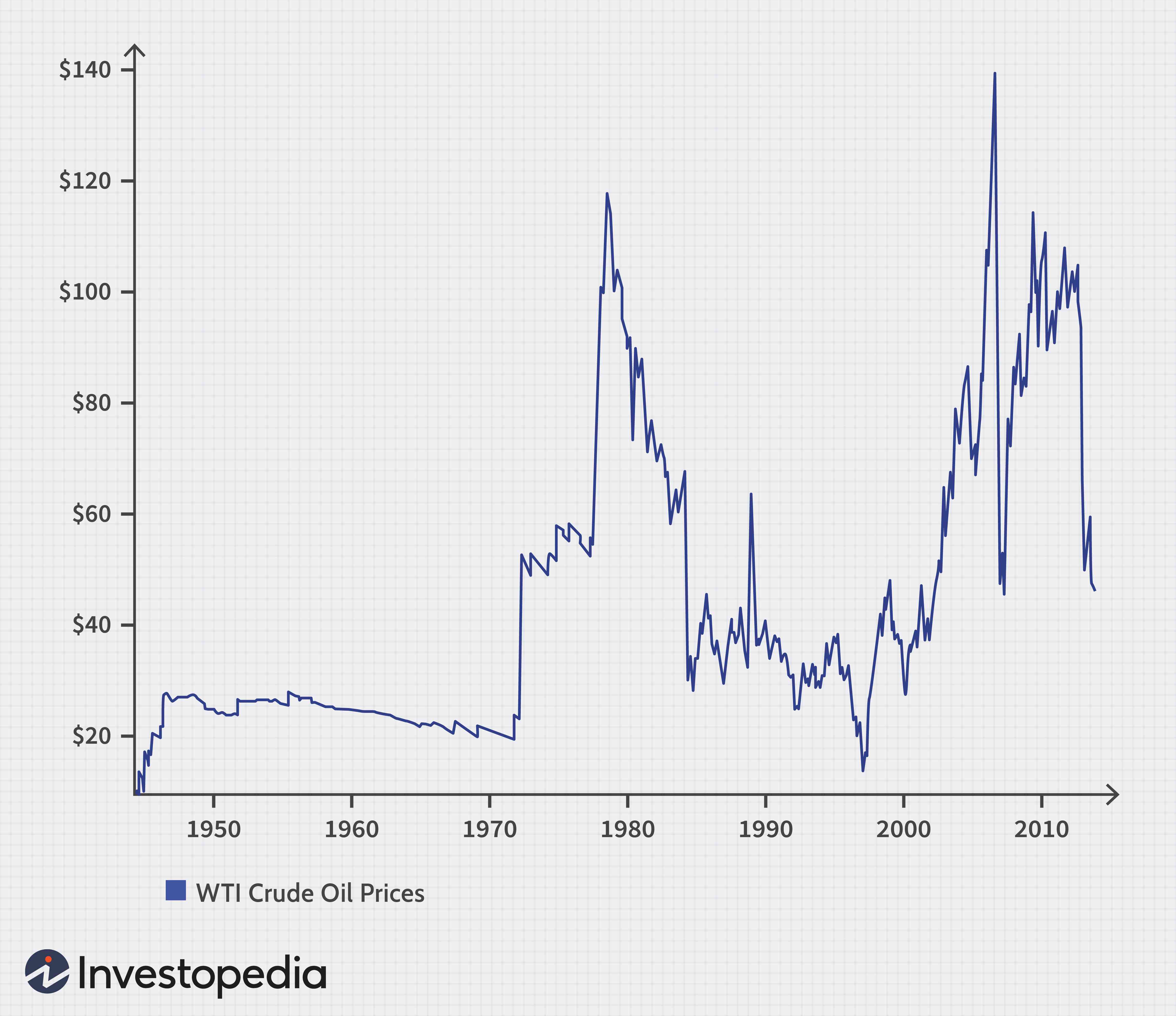

Economic Energy Outlook In 2013, the cost of crude oil is nearing $100 a barrel, indicating a rise of 4 percent. Analysts forecast that triple digits are not too far off in our future. Gas prices at the pump are costing 14 cents more per gallon than they did in December 2012, adding to an 8 percent rise in gasoline futures.

In contrast, natural gas prices, although experiencing periodic fluctuations in the past, have fallen 4 percent. According to energy analysts one of the reasons stem from a more positive economic outlook, prompting oil companies to raise prices in anticipation of more spending on travel. This forces consumers to divert or slow spending on other items and services, reserving more money for fuel costs.

Beth Bovino, deputy chief economist at Standard & Poor’s, states, “We’ve withstood $100 a barrel before, and we can do it again.” Yet she believes that a rise to $150 a barrel might be more daunting.

Recent oil production which has seen a recent boom, there are no expectations for record prices during 2013. Estimates range from a high of $3.50 to $3.90 a gallon for the coming year, according to Oil Price Information Service’s chief analyst, Tom Kloza.

In April of last year, oil prices topped out at $3.94 a gallon. The average cost of gas is projected to range from $3.25 to $3.50 a gallon, which beats last year’s figure of $3.60 a gallon; which spurred a record $479 billion at the gas station pump for consumers.

The Benefits of Investing in Oil

Investing in oil and gas can be a very profitable venture for many. Investor rewards include monthly cash flow returns and specific tax advantages that are not realized in other investment strategies, such as stocks, bonds and real estate.

Oil investing involves minimal risk because there are no radical up and down turns like in the stock market. This makes it a safer bet during economic swings since oil prices and production is relatively stable in comparison to other investment areas.

Oil reserves are here to stay for the foreseeable future and in no danger of suddenly disappearing, which could result in a financial crash. It takes one to four years for a 100 percent investment recoup, shortening the gain and profit term considerably.

Oil investment also diversifies and enhances the portfolio, along with providing replenishing assets. The concentration on leases that are under-financed, under-developed or mismanaged offers minimal risk factors to the oil investor.

Investment Strategies

Interacting with a stable, experienced gas and oil company can provide a personalized education in understanding the industry, production statistics and management procedures. This aids in avoiding unnecessary risks and maximizing profits. This is essential since oil and gas companies are not all equal. They vary in experience, diversification, venture profit, track record and global presence.

The smart course is to invest in successful and proven oil fields where the supply is already present and plentiful. Newer companies intent on finding new strikes or reactivating old sites are risky because of the odds factor and possible inexperience of upper management. Mismanagement of dividends and shoddy record keeping can keep the investor from realizing full and honest profit potential.

The most important facet to oil and gas investment involves a complete study plan beforehand which outlines the benefits and risks, along with a solid knowledge of the science and production practices of the industry.

About Author:

Guest author Logan Wheeler enjoys sharing his tips on finance with an online audience, and contributes articles on oil investing for U.S. Emerald Energy.