No borrower should walk into the mortgage application process uninformed. If you are ready to buy a home, chances are you have questions, but it is very common to forget to ask the right questions when you are put on the spot. This is why it is very important to write down a list of all of the imperative questions you want to ask mortgage lenders before you take a trip to their offices or pick up the phone. When you ask questions, you will get the answers you need to choose the best mortgage for your current circumstances.

No borrower should walk into the mortgage application process uninformed. If you are ready to buy a home, chances are you have questions, but it is very common to forget to ask the right questions when you are put on the spot. This is why it is very important to write down a list of all of the imperative questions you want to ask mortgage lenders before you take a trip to their offices or pick up the phone. When you ask questions, you will get the answers you need to choose the best mortgage for your current circumstances.

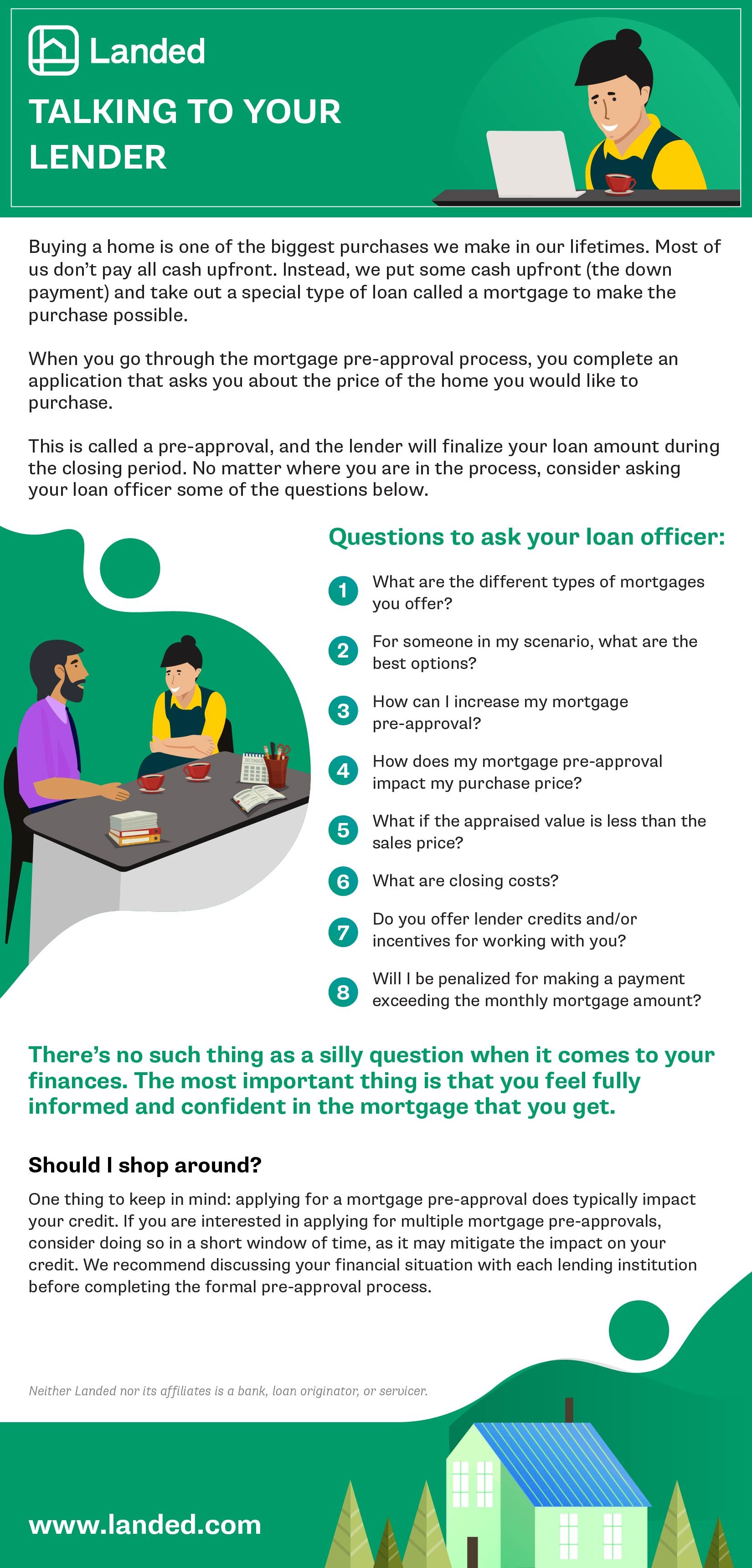

Top 7 Questions to Ask Lenders in the Mortgage Industry

After sifting through a long list of the mortgage lenders in the industry and narrowing down your choices, ask the finalists these questions to find the best overall loan:

1. What is the Annual Percentage Rate on This Loan?

While it might sound like an obvious question to ask, many lenders will quote prospective borrowers with an interest rate and not the APR. The interest rate quoted typically does not include the fees that are charged for the origination of the loan. Many APR advertisements do not include all of the fees that are charged once the loan has been approved. Be sure to ask your lender if all origination fees, interest rates, and points are included in the APR so that you can do an accurate comparison.

2. Will I Need to Pay Discount or Origination Points?

In some cases, a mortgage lender will quote you a lower interest rate by charging your prepaid mortgage points. Make sure to ask the lender how much you will be required to pay in points to get the lower rate. When you compare the fee to the savings, you can determine if this is the right move for you.

3. Will It Cost to Lock in the Rate?

Mortgage interest rates change every minute. What you were quoted yesterday can change tomorrow. If you want to lock in your rate at the time of application, some mortgage lenders require you to pay lock in rate fees.

4. Will There Be a Prepayment Penalty if You Pay the Loan Off Early or Refinance?

Mortgage lenders make their money over time. Because of the cost of originating a loan, some lenders require you to keep your loan for a specified period of time or you will be assessed a prepayment penalty. Most penalties are between 3 and 6 months’ interest, but some can be higher. Find out about the stipulations of these penalties.

5. How Long Does Processing Take?

Some lenders take longer than others to process mortgage loans. In a peak season, processing may take longer than it would when home sales are low. You should ask how long the lender expects processing to take so that you know how long to lock in your loan rate.

6. What Documents Will the Processor Need?

Many mortgage lenders have developed stricter guidelines when it comes to documentation. Ask the lender what documentation you will need to gather in advance so that the process is not delayed. After all, some of the documents you need from creditors and other organizations might take time to receive.

Make sure to bring this list of questions with you. Take notes when you are asking the questions and bring the answers home with you. By doing this, you can make an informed decision and choose the best lender offering the best loan.

This piece was composed by Steven Jacksonville, a freelancer with a focus on finance, real estate, the mortgage industry, international business, financial regulation and other related topics. Those interested in purchasing a home in the near future may benefit from the Equity Release Calculator available here.